Table of Content

1.Virtual Banking Assistant

2.Biometric Authentication

3.Cross Border Payments

4.Finance tracking

5.Automated payment reminders

Introduction:

The growth of fintech since 2020 is exponential and that’s not just a statement, it is a fact!

All over the world, the governments have recognised the might of the Fintech Industry which has the potential to contribute a major sum to the economy over this decade.

If you are planning to build a fintech app, this is the right time. And Zazz will be more than happy to help you get started

Let’s look back! –

In the past decade, compared to Fintech, the technology trends in other industries were easily and fearlessly adopted. People did give a tough time to fintech by being reluctant to adapt to it, as it involves their hard earned money. The trust issues were higher in fintech in the past decade because security of funds was a major concern. But, The ‘social distance’ norm broke this reluctance among people forcing mass adoption of FinTech in 2020, which led to a significant change in the way people interact with money. This forced adoption eventually increased people’s reliance on FinTech. And today, people couldn’t be more convenient and secure with it.

FinTech companies today are constantly innovating to bring better features that encourage the inclusion of underbanked and unbanked as well as elevate the digital payment experiences of the banked.

Here are some most advanced FinTech App features that are to gain popularity in 2024.

If you are building a fintech app, the following are some of the features you should consider incorporating. In case you need assistance in building your fintech application, get help from app experts at Zazz.

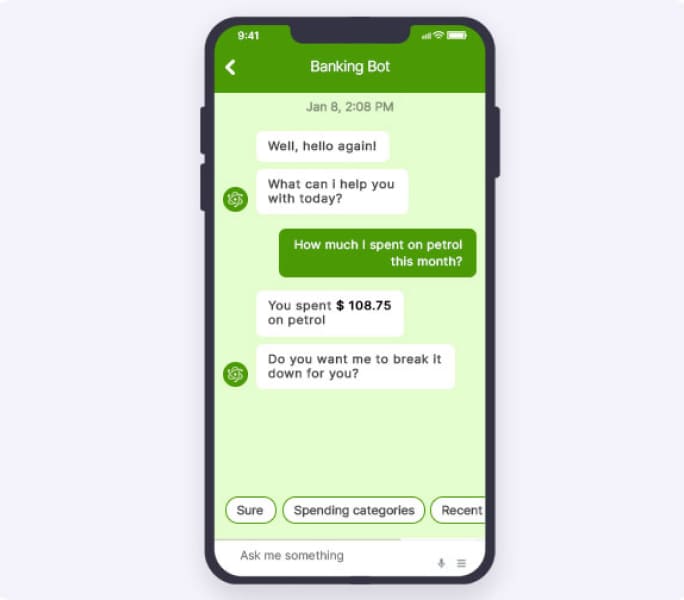

1. Virtual Banking Assistant:

This is an AI backed feature that is incorporated by many banks to improve the online banking experience of customers. While some virtual assistants are voice activated, some allow only typing and some allow both.

How does it help?

- Common queries or most asked questions are answered by the virtual assistants saving customers from spending a lot of time reaching out to customer care.

- Simple transactions can be done via voice command. If you want to send $50 to your friend, you can simply ask your virtual banking assistant to do it on the go without having to do anything manually.

- It can effectively orient customers on the app. For example, if the app is updated and everything seems new or sometimes you might get lost on the app for various reasons, in which case, Virtual banking assistants come to your rescue helping you find what you were looking for.

- The moment it detects any suspicious activity, it will send you instant notification to prevent you from potential fraud.

Related reading: Guide to Building Profitable Fintech Mobile Apps

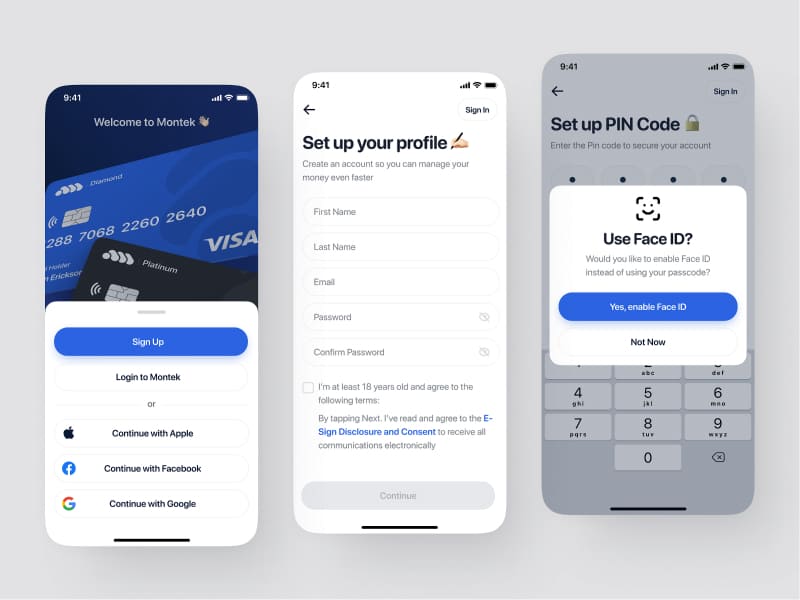

2. Biometric Authentication:

The more people are heading towards digital economy, the more they are open to cyber attacks. A mere pin or password security is likely to be hacked. The integration of Biometric authentication can help financial companies to effectively fortify their customers’ accounts making them resistant to cyber fraud.

How does it help?

- Biometric authentication is based on unique physical characteristics of a person, such as fingerprint, iris & facial features which cannot be forged. While there is a remote possibility of fingerprints being hacked, the integration of AI today, has toughened the protection shield making it impossible to even forge fingerprints anymore.

- It is a unique identification factor that helps financial apps to accurately identify users whether they are new or

- Along with boosting security, it also improves convenience of users as they don’t have to remember passwords and pins everytime they authorize a transaction.

Related reading: Do you know what is fintech & its benefits For Your Company?

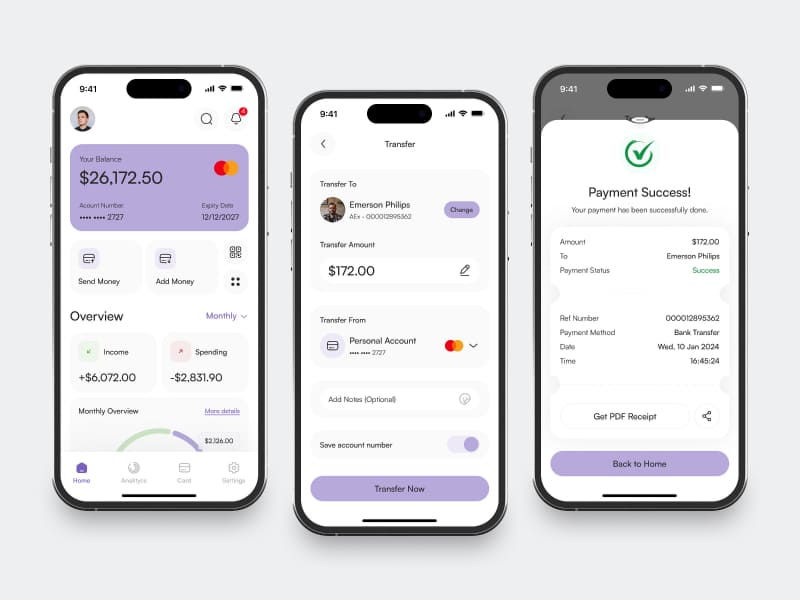

3. Cross Border Payments:

A feature just introduced in some countries and much-anticipated in many countries.

Many banking and payment apps across Asia, UK, US and Canada are facilitating cross border payments to break the barriers in business transactions and remittance payments.

How does it help ?

1. It stands as the primary feature that boosts financial inclusion.

2. Cross border payment serves as a boon for businesses across the globe by straightening out trade expansion thereby diversifying revenue streams for many small businesses, particularly homepreneurs. Businesses integrating checkout solutions into their global operations can efficiently process international transactions while maintaining security standards. Now merchants can connect with multiple acquirers globally who can streamline procurement of materials locally.

3. It lowers the currency exchange fee and mitigates the risks of fraudulent activities.

4. It facilitates immediate cash flow and enhances global connectivity by eliminating hindrance in transactions for both senders and receivers.

Related reading: Fintech App Development Challenges and How to Overcome Them

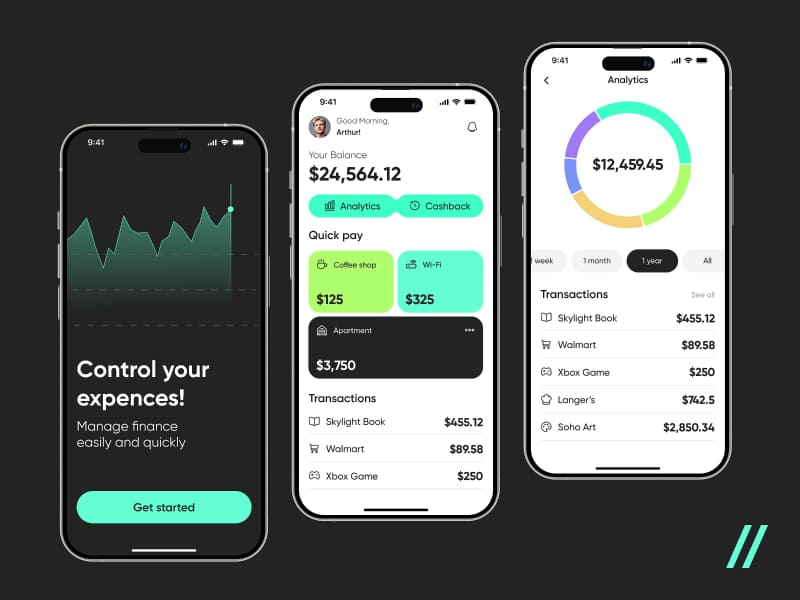

4. Finance tracking:

A feature that every financial app should provide for users to develop the habit of mindful spending.

How does it help?

1. By producing automated expense analytics, this feature helps individuals or businesses to identify unexpected or unnecessary expenses done for the month or year.

2. Payment receipts, tax documents and other financial docs can be securely stored and accessed as and when required.

3. Provides budgeting insights based on the expenditure history which helps the users to strategically prepare a budget for their family or their business.

Pro-tip for businesses: Instead of going for a ready-made or 3rd party finance tracking app, build a custom-made finance tracker app exclusively for your business based on its structure and requirements. This way you can retain the confidentiality of your financial records.

To build your own finance tracker app, get the help of app experts at Zazz.

Related reading: Top App Development Companies in New York

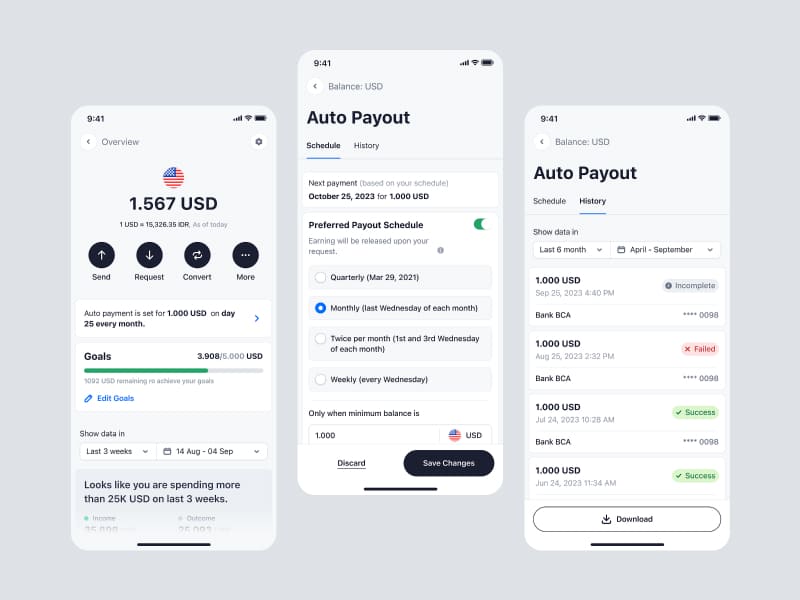

5. Automated payment reminders:

A feature that is most beneficial for BFSI and subscription businesses which depend on recurring payments. Many payment platforms have integrated this feature for the benefit of both senders and receivers.

How does this help?

1. It helps companies collect payments on time by sending automated payments reminders on and before the due date. Companies streamline their payment processes by integrating accounts payable management software into their financial workflow.

2. The notification history helps businesses to understand their customers’ payment behaviour. -whether the customer has immediately paid after receiving the notification or whether the customer has ignored the notification or whether the customer has attempted payment but failed.

3. In case a transaction fails after an attempt, the follow up reminder can be sent with a payment link for customers to try an alternative payment method.

4. These automated payment reminders eliminates the consequences of forgetfulness and also prevent individuals from unconscious spending by keeping them under check.

Related reading: Zazz Ranked Among Top Mobile App Development Companies In USA

Conclusion:

2024 is expected to create a new record in digital economy and Financial technology is greatly contributing to it. Fintech trends will not stop with this, new trends will take us by surprise in the coming years. So, how ready are you ? Did your fintech app adapt to these fintech trends mentioned above?

Do you want to build a fintech app with all essential features?? Whatever your app requirement is, reach out to our app experts at Zazz to build the most-functional fintech application.

Recent Articles

Table of Content 1. What is IT Staff Augmentation? 2....

Table of Content 1. What is Staff Augmentation for App...

Table of Content 1. What is IT Staff Augmentation? 2....